Why Now Might Be the Smartest Time to Buy in Central California

Dispatch No. 003

In a real estate market clouded by uncertainty, Central California stands out as a beacon of opportunity. While national headlines focus on high interest rates and affordability challenges, savvy buyers and investors should turning their attention to the Central Valley—a region poised for growth amid shifting economic and legislative landscapes.

The National Landscape: A Market in Flux

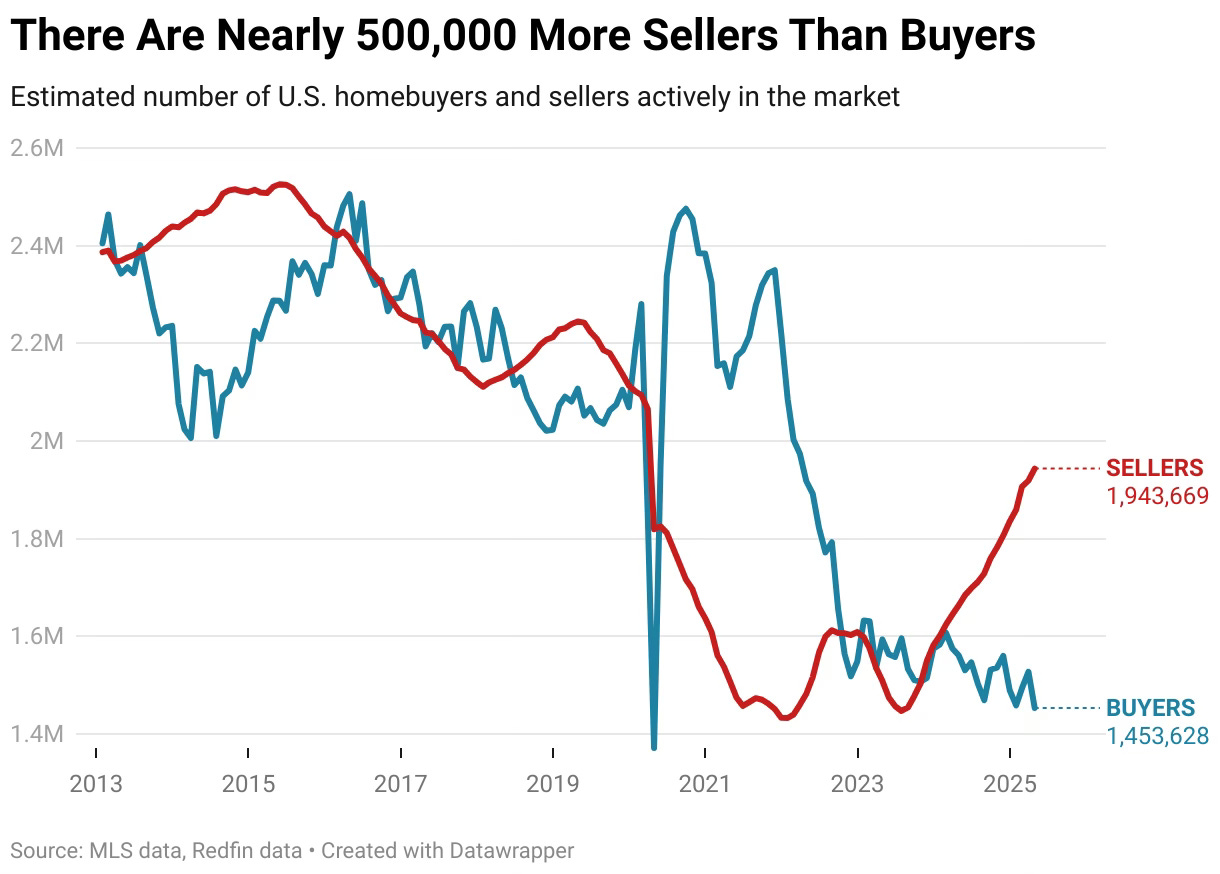

Across the U.S., high interest rates, inflation, and buyer hesitation have slowed the real estate market and triggered price corrections in formerly hot regions. According to Redfin’s May 2025 report, there are now more sellers than buyers, pushing prices downward in places like Austin, Boise, and parts of Florida—where home values have dropped more than 10% year-over-year (Redfin Report). These corrections highlight how quickly overheated markets can shift, but they also open doors for savvy buyers. With less competition, falling prices, and the potential for lower rates ahead, now may be an opportune time to buy. The proposed "One Big Beautiful Bill Act"—extending 100% bonus depreciation and raising the SALT cap—could further boost investor confidence in high-cost states like California (Skadden, Proskauer Tax Talks).

California's Housing Crisis: A Self-Inflicted Wound

California's housing affordability crisis is largely a result of its own policies. Overregulation, restrictive zoning laws, and bureaucratic red tape have stifled housing development, leading to a shortage of affordable homes. The state's permitting processes are among the slowest in the nation, with San Francisco's approval timeline averaging over two years (Wikipedia).

But change appears to be underway. Recognizing the dire need for reform, Governor Gavin Newsom recently proposed new measures to cut red tape and fast-track housing development, signaling a shift toward more pro-development policies (Governor's Press Office).

Central California: The Emerging Opportunity

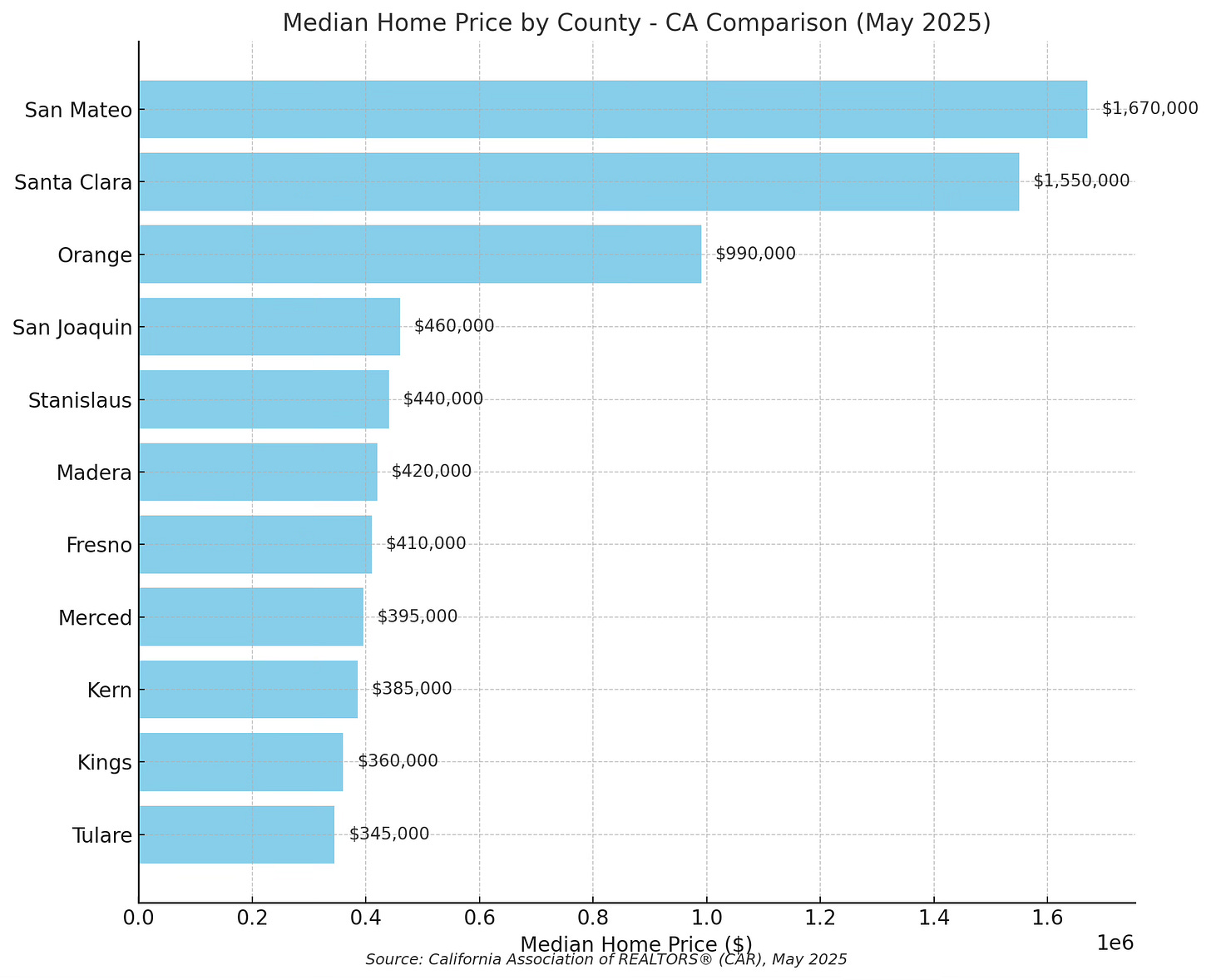

Central California offers a unique combination of affordability, growth potential, and supportive policy changes. Cities like Fresno, Bakersfield, and Visalia boast median home prices significantly lower than the state average, making them attractive options for first-time buyers and investors alike.

The region is also benefiting from state-level legislative efforts aimed at increasing housing supply. For instance, Senate Bill 79, recently passed by the California Senate, encourages dense residential development near transit lines—a policy that could bring smart growth to many Central Valley communities (Axios). In Tulare County, Santa Fe Commons recently opened as the first affordable housing project of its kind in the City of Tulare, offering 81 affordable rental units, including 25 reserved for Permanent Supportive Housing (Self-Help Enterprises).

Meanwhile, cities like Visalia are moving forward on major housing and commercial developments designed to meet the needs of a growing population. In October 2023, the Visalia City Council approved plans for a 507-acre development in the northern part of the city, which includes a mix of housing, retail, and park space—anchored by a large commercial retailer intended to drive job creation and local commerce (Fresnoland). Additional large-scale proposals, such as SJV Homes' 556-home project in Tulare and West Star Construction's 3,300-home community in northwest Visalia, are being advanced to meet demand (The Business Journal, ABC30).

Infrastructure investments, population growth, and increased local collaboration are all aligning to make Central California the next wave of smart, strategic real estate investment.

Why Homebuyers Shouldn’t Wait

Despite high interest rates, there are compelling reasons for homebuyers to act now: with fewer active buyers in the market, sellers and builders are offering meaningful incentives like rate buy-downs and closing cost credits, allowing buyers to negotiate more favorable deals, lock in pricing before rates fall and competition returns, and refinance later to secure long-term affordability.

According to a recent Redfin report, nearly 42% of sellers in Central California markets offered concessions in Q1 2025—up from just 30% one year prior. That includes rate buy-downs, appliance packages, and cash toward closing. Smart buyers are using this climate to get into a home at today’s prices while planning for tomorrow’s better terms.

Looking closer at Tulare County specifically, the opportunity becomes even more clear:

As of May 2025, the median home price in Tulare County was $345,000, compared to the California statewide median of $843,340 (CAR Market Data).

Homes are spending an average of 32 days on market, giving buyers more room for negotiation before competition increases later in the year.

Tulare County’s active listings increased by 18% year-over-year, offering buyers more inventory to choose from in a region where inventory has often been tight.

According to Zillow, home values in Tulare County have increased by 4.7% year-over-year, indicating continued appreciation even in a higher-rate environment (Zillow Research).

Tulare County offers a realistic path to homeownership for families and first-time buyers, with lower prices, rising values, and less competition making it a smart market to enter now.

Investor Advantages: Timing Is Everything

For investors, Central California offers a timely opportunity. Property prices remain well below coastal markets, and favorable policy shifts—like expanded SALT deductions and efforts to streamline development—are aligning with housing supply reforms. With affordability and legislative momentum on their side, investors who act now are well-positioned to capitalize on long-term growth.

Visalia, centrally located with direct access to major logistics corridors, is becoming a supply chain hub. CapRock Partners' 2.7-million-square-foot industrial complex is just one sign of rapid economic development driving demand for both single-family and multifamily housing (CapRock Partners). Combined with Tulare County’s broader economic growth in agriculture, transportation, and retail, Visalia is fast emerging as a distribution and food production center (The Business Journal).

Population growth projected through 2040 and local jurisdictions increasingly welcoming higher-density and infill housing projects only enhance the investment case. As demand for workforce housing rises, build-to-rent developers, home developers, and multifamily investors have a growing opportunity to meet that need in a region where affordability, scale, and policy finally align.

What This Means for Sellers

While much of the conversation has centered on buyers and investors, sellers face their own unique decision-making moment. According to an August 2024 Redfin report, 85.7% of U.S. homeowners with mortgages have an interest rate below 6%, contributing to the 'lock-in effect' where homeowners are reluctant to sell and take on higher rates (Redfin)). This phenomenon, commonly referred to as the “rate lock-in effect,” has contributed to historically low inventory.

However, for sellers who are sitting on years of appreciation, now could still be the right time to make a move. Trading in a lower interest rate may seem like a loss on the surface, but many sellers have built significant equity since purchasing their homes. In fact, as of early 2025, U.S. homeowners with mortgages saw a collective annual equity increase of $425 billion in Q3 2024, with the average borrower now holding approximately $311,000 in home equity (The Mortgage Reports) & Federal Reserve Bank of St. Louis). That equity can be converted into larger down payments on upgraded properties, often resulting in smaller overall loan amounts even at higher interest rates.

Additionally, today’s less competitive buyer environment means move-up sellers will face less pressure when shopping for their next home—more selection, more negotiating power, and a better chance to get into a property that truly fits their next chapter.

Conclusion: Seize the Momentum

Central California sits at the crossroads of affordability, investment potential, and policy reform. Much like after the 2008 crash, today's market offers a rare opportunity for homebuyers to negotiate better deals, lock in lower prices, and plan for refinancing when rates drop—especially in regions poised for growth like Tulare and Visalia.

For investors, the early signs of industrial expansion and population growth echo past cycles of value creation. Markets like Visalia, Tulare, and Fresno are still overlooked yet ripe with potential for rising rents and property values.

Looking ahead, with tech giants like OpenAI reinvesting in Silicon Valley (Los Angeles Times), migration back to California may accelerate. Central California, with its relative affordability and expanding economy, is well-positioned to benefit from both population shifts and relaxed development policies—making it one of the most promising frontiers for real estate in the coming cycle.

Interested in exploring opportunities in Central California? Contact me today to discuss how you can take advantage of this emerging market.